- europages

- >

- COMPANIES - SUPPLIERS - SERVICE PROVIDERS

- >

- taxes

Results for

Taxes - Import export

B&SI SERVICE LTD

Bulgaria

Organisation of the company accounting form and elaboration of the company policy; Preparation and update of an own chart of accounts; Setting up individual detailed accounts; Processing of primary accounting documents, income documents, receipts, bank documents, etc.; Preparation and keeping accounting registers; Accounting for fixed tangible and intangible assets; Elaboration of an accounting and tax depreciation schedule and accounting of fixed asset depreciation; Accounting for company stock; Calculation of item and service cost; Preparation and submission of monthly logs and statement-declarations under the VAT Act and VIES; Submission of information related to the Intrastat system; Accounting for and analysis of accounts with contractors, suppliers and clients; Current regular reports and analyses in relation to the accounts with suppliers and clients, warehouses and cash flows, income, expense and other indicators, for your needs as a company manager.

Request for a quote

TEVOLUTION LTD

United Kingdom

One Stop Shop Service: Bring Your Stock Closer to Your UK Customers! Streamline your business operations with our comprehensive all-in-one service. From tax representation, customs clearance, customs compliance, product compliance, to VAT reporting – we've got you covered! Why Choose Us? Simple Goods Management Cycle: Pay taxes and duties seamlessly at every point Flexibility: Easily move goods to any required process. Remission Advantage: Apply for remission if goods are returned within three years of export. Achieve faster deliveries and increased customer satisfaction by having stock readily available in the UK. Choose efficiency. Choose our one-stop-shop service.

Request for a quote

TEVOLUTION LTD

United Kingdom

As a leading International Trade Consultancy and Customs Broker, Tevolution Ltd can significantly improve and de-risk cross-border trade operations and customs clearance processes. A customs clearance agent is a very important element in the value chain, and the level of expertise of a customs broker can have a significant influence on the level of compliance and maintenance of the required level of risk tolerance for the entities involved.

Request for a quote

PROFELEC

France

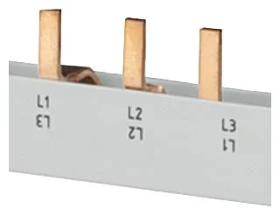

Your reference product 5ST3740 is delivered from 3 days after the confirmation of your order. The exact delivery date will be indicated upon confirmation. Free delivery from 1,000 € of purchase. We deliver to France, Reunion, Belgium, Switzerland, Luxembourg, Canada, Haiti, Congo, Madagascar, Cameroon, Ivory Coast, Niger, Burkina Faso, Mali, Senegal, Rwanda, Guinea, Benin, Burundi, Gabon, Djibouti , Algeria, Morocco. Tunisia, Mauritania, Nigeria, Senegal. How to buy To place an order, add your products to the basket and send your request. We will contact you within the next working hour and you will receive confirmation of your order and your invoice. For any additional information, please contact us via the site's messaging service or by email at contact@profelec.fr or by telephone from 8 a.m. to 5 p.m. on 01 87 65 30 80.

Request for a quoteDo you sell or make similar products?

Sign up to europages and have your products listed

AGATHOR LEGAL SERVICES AND CONSULTANCY

Turkey

Agathor advises on tax planning and structuring, transfer pricing and tax dispute resolution to individual and corporate clients. Our purpose is to minimize the tax liability for all of our clients. Our marginality comes from providing consultancy for both local and international operations all around the world. Agathor’s specialized team offers various perspectives to its clients regarding tax and commercial transactions, tax dispute resolution, insurance tax and VAT/indirect taxation.

Request for a quote

SHERWIN CURRID ACCOUNTANCY

United Kingdom

Working for yourself means taking charge of your own tax affairs, which can be intimidating if you’ve got used to your employer looking after them for you. We can offer practical help and advice on all aspects of personal tax, ensuring you comply with HMRC rules, and make all your returns and payments on time. We offer a range of specialist financial advice for contractors and freelancers through our dedicated division SC Plus. At Sherwin Currid, we also have particular expertise in tax for non-UK residents, and cross-border tax arrangements for expat individuals and businesses.

Request for a quote

EGOROFF COMMUNICATIONS AGENCY

Russia

For more than 10 years, our linguists have been translating financial statements and marketing documents for any cultural environment, which is necessary for effective business abroad. We have a team of financial translation experts who have extensive experience in the banking and financial sectors, and they know bank documentation and terminology well. All of them are native speakers of the languages in which they translate. Thus, we are ready to provide our customers with an accurate and prompt translation of financial and business documents, such as: Insurance policies and applications Economic reports Tax forms Bank statements Investment documents Advertising brochures for banks and insurance companies Loan documents Market Analysis

Request for a quote

B&SI SERVICE LTD

Bulgaria

The excellent knowledge of tax legislation and over 30 years of experience in the relations with government institutions and the tax administration in particular, allow us to plan and optimize your tax liabilities ultimately sparing your budget. We offer you: -Advice on direct and indirect taxation - ATINP, Act on Local Taxes and Fees /ALTF/, CITA, VAT Act, Act on Excise and Tax Warehouses /AETW/. -Tax protection at inspections – we render assistance during tax inspections, and this includes the preparation of written explanations, appeals and any other correspondence with the respective government institutions. -Protection against issued acts for administrative and tax violations – the difference at interpreting tax acts, regulations and their application sometimes leads to various administrative and tax penalties. In such cases we make statements, objections and comments to the parties. -Optimization of company tax liabilities and tax risk minimization, and overall tax planning.

Request for a quote

TAX NAVIGATOR

United Kingdom

We handle the whole chain of services for VAT returns: registration and communication with HMRC, calculation, input and output data, and even deregistration. Moreover, we advice our clients on the best VAT scheme for their business and make sure they get the maximum value added tax return specified by the accounting legislation. In addition, we focus on quality communication with our clients, making sure their best interests are taken care of. Integrity, dedication, and loyalty are key components of our work ethics.

Request for a quote

ANDREW PASSER ACCOUNTANT

United Kingdom

Andrew Passer accountant for small business - accounting and tax advisory services to clients in London and Greater London areas. Managing your business tax, accounting, bookkeeping and payroll. A full range of accountancy services, including financial statement preparation, tax planning and compliance, and advisory services for small businesses. With personalised proactive advice I am committed to providing exceptional service and making your business tax efficient.

Request for a quote

ANDREW PASSER ACCOUNTANT

United Kingdom

Andrew Passer accountant specialising in property tax and accounting for landlords and property investors. Get the best expert advice and guidance for your needs. I have 40 years years of experience in property taxation I am well-equipped to handle all your tax and advisory matters. I will advise you on the most tax-efficient strategies and ensure that your documents are completed and returned correctly. Whether you are a first-time landlord, have a holiday-let or multiple tenanted properties, I can assist you with all your property tax related needs, from tax planning and advice to the preparation and submission of tax returns. Services include; Property tax planning and advice Preparation and submission of tax returns Property tax reliefs and exemptions Advice on capital gains tax Advice on stamp duty land tax for property purchases Advice on inheritance tax for property owners

Request for a quoteResults for

Taxes - Import exportNumber of results

13 ProductsCompany type

Category

- Accounting and auditing (5)

- Auditing, international (1)

- Bathroom accessories (1)

- Brokers, customs (1)

- Business Consultancy (1)

- Business translations (1)

- Consultants, financial analysis (1)

- Control switches - electric (1)

- Financial advisers (1)

- International trade consultants (1)

- Packing and packaging - machinery and equipment (1)